Sukanya Samriddhi Yojana: A Guaranteed Promise for Your Daughter’s Golden Future

For a father, the entire world is reflected in his daughter's smile; for a mother, tomorrow's hopes glimmer in her child's eyes. From the moment you first held those tiny fingers to the day she stands confidently on her own feet, every parent dreams of being her unwavering support. The heartfelt desire to ensure that her higher education remains uninterrupted and that her wedding is celebrated with grandeur is a priceless sentiment. Embracing this very love and standing as a pillar of support for your daughter's growth is the 'Sukanya Samriddhi Yojana' (SSY) . This is not merely a savings scheme; it is the most precious gift you can bestow upon your daughter.

The Vision and Purpose

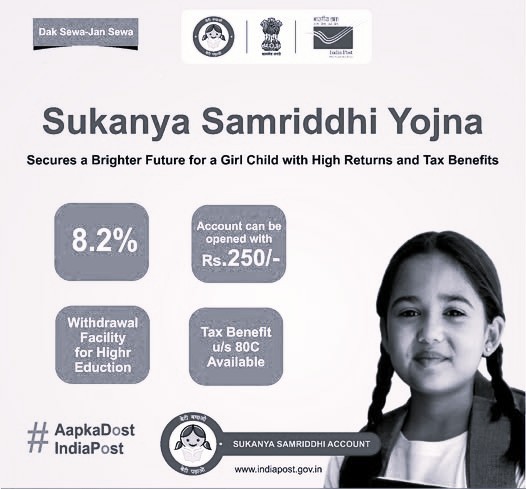

Launched as a flagship component of the Central Government’s 'Beti Bachao Beti Padhao' (Save the Daughter, Educate the Daughter) initiative, SSY has emerged as one of the most popular savings instruments in India. It offers an extraordinary opportunity for middle-class and lower-income families to build a substantial financial corpus for their daughter’s education and marriage expenses. Because it is backed by a sovereign guarantee from the Government of India, your investment is entirely risk-free and secure. Currently, the government offers an attractive annual interest rate of 8.2% , which is significantly higher compared to most other traditional savings schemes.

Eligibility and Account Opening

To enroll in this scheme, the girl child must be under 10 years of age . Parents or legal guardians can open this account in the name of their daughter at any nearby Post Office or authorized public and private sector banks (such as SBI, HDFC, ICICI, Axis, PNB, and Post office). Generally, the scheme allows only two accounts per family, one for each daughter. However, a special provision exists, in the event of the birth of twins or triplets in the first or second pregnancy, a third account can be opened to ensure all daughters benefit equally. To initiate the process, the girl's birth certificate is mandatory, along with the parents' Aadhaar card, PAN card, and proof of residence.

Investment Structure and Growth

The flexibility of the Sukanya Samriddhi Yojana makes it accessible to everyone. One can start with a minimum annual deposit of as little as ₹250 , while the maximum limit is capped at ₹1.5 lakh per financial year. A key feature of this scheme is the 15-year deposit mandate; you are required to contribute for only the first 15 years from the date of opening the account. After this period, you no longer need to make deposits, yet the balance continues to accrue compound interest until the account completes its full 21-year maturity cycle .

For instance, if you save ₹5,000 per month for 15 years, your total principal investment would be ₹9 lakhs. By the time the account matures at 21 years, the total amount, including accumulated interest,will grow to approximately ₹27.73 lakhs , providing a significant financial cushion for your daughter’s dreams.

Unmatched Tax Benefits: The EEE Advantage

The primary attraction for many investors is the tax efficiency of the SSY. It falls under the prestigious EEE (Exempt-Exempt-Exempt) category of the Income Tax Act.

Exempt on Investment:

Contributions up to ₹1.5 lakh per year are eligible for deduction under Section 80C .

Exempt on Accumulation:

The interest earned annually is completely tax-free.

Exempt on Maturity:

The final lump sum received at the time of maturity is also exempt from income tax.

Essentially, every penny generated through this scheme remains as profit for your daughter.

Withdrawal and Premature Closure Norms

The scheme is designed with the girl's milestones in mind. Once the girl reaches 18 years of age , a partial withdrawal of up to 50% of the balance is permitted specifically for the purpose of higher education. If she chooses to marry after the age of 18 but before the 21-year maturity, the account can be closed prematurely to fund the wedding. In unfortunate circumstances, such as the untimely demise of the girl child or the guardian, or in cases of life-threatening medical emergencies, the account can be closed, and the entire amount with interest will be handed over to the nominee or guardian.

Investment vs. Returns Analysis (Estimated at 8.2% Interest)

Note: The final maturity amount may vary based on periodic changes in interest rates announced by the government.

Operational Guidelines and Convenience

While a new account currently requires a physical visit to a bank or post office for verification, managing the account has become highly digitalized. You can download the application form from official bank websites, submit it once, and thereafter handle all transactions online. Through IPPB (India Post Payments Bank) or standard Net Banking, you can set a 'Standing Instruction' to automatically debit the savings from your account every month, ensuring you never miss a payment and avoid the nominal ₹50 penalty for default. Furthermore, the SSY account is highly portable; if you relocate to another city, you can easily transfer the account to any authorized bank branch or post office across India.

The joy that filled your home when Goddess Lakshmi first entered in the form of your daughter should only multiply as she grows; it must never be overshadowed by the looming clouds of rising expenses. Years from now, when she achieves great heights in her career or stands radiantly at the altar as a bride, your eyes should reflect only the profound satisfaction of having secured her future, not the anxiety of financial lack. The small step you take today by investing in the Sukanya Samriddhi Yojana will serve as the foundation for the sky your daughter dreams of soaring in. This is not just wealth you are accumulating; it is the self-confidence and unwavering security you are gifting to your child.