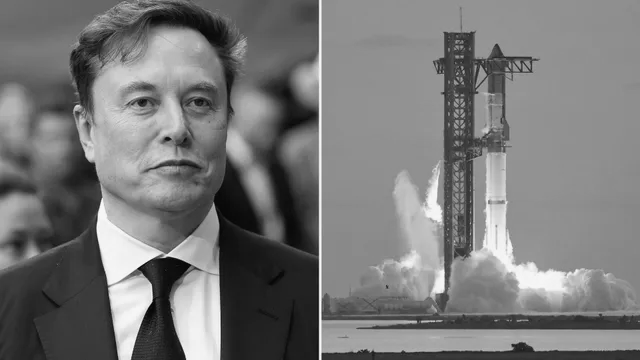

SpaceX Acquires xAI as Musk Reshapes Tech Empire Before IPO

Elon Musk has moved to consolidate his space and artificial intelligence ambitions, with SpaceX acquiring xAI , a step widely seen as preparation for a large initial public offering (IPO) later this year. The merger brings together Musk’s rocket, satellite, AI and social media businesses under a single corporate umbrella.

SpaceX said the deal will combine several of Musk’s offerings, including the Grok AI chatbot , the Starlink satellite communications network , and the social media platform X . Musk has repeatedly spoken about accelerating the development of technology that would allow data centres to operate in space , a goal that could become easier with rockets, satellites and AI housed within one entity.

A key driver behind the merger, according to industry analysts and media reports, is the huge cash requirement of artificial intelligence . Training and running advanced AI models demands massive investments in data centres, computing hardware, power and cooling infrastructure . Folding xAI into SpaceX gives Musk access to SpaceX’s stronger balance sheet , recurring revenues from Starlink , and its ability to deploy infrastructure at scale, including Musk’s longer-term vision of space-based, solar-powered AI data centres .

Founded in 2002, SpaceX has transformed private spaceflight through its Falcon rockets , the Starship programme and the Starlink satellite constellation , becoming a global leader in launch services and satellite internet. xAI , launched in 2023, aims to build artificial intelligence systems aligned with human interests and has been rapidly scaling its computing capacity to compete with established AI players. Musk acquired X (formerly Twitter) in 2022 and has since positioned it as a data-rich platform tightly integrated with AI development.

The consolidation also strengthens Musk’s control over an expanding technology empire. In addition to SpaceX and xAI, Musk is the largest shareholder and chief executive of Tesla , the electric vehicle maker; he owns The Boring Company , which focuses on tunnel construction and infrastructure; and he co-founded and controls Neuralink , which is developing brain–computer interface technology .

By bringing his space and AI ventures together, Musk is positioning himself to dominate multiple high-growth sectors while presenting investors with a more diversified and integrated company ahead of a possible IPO.