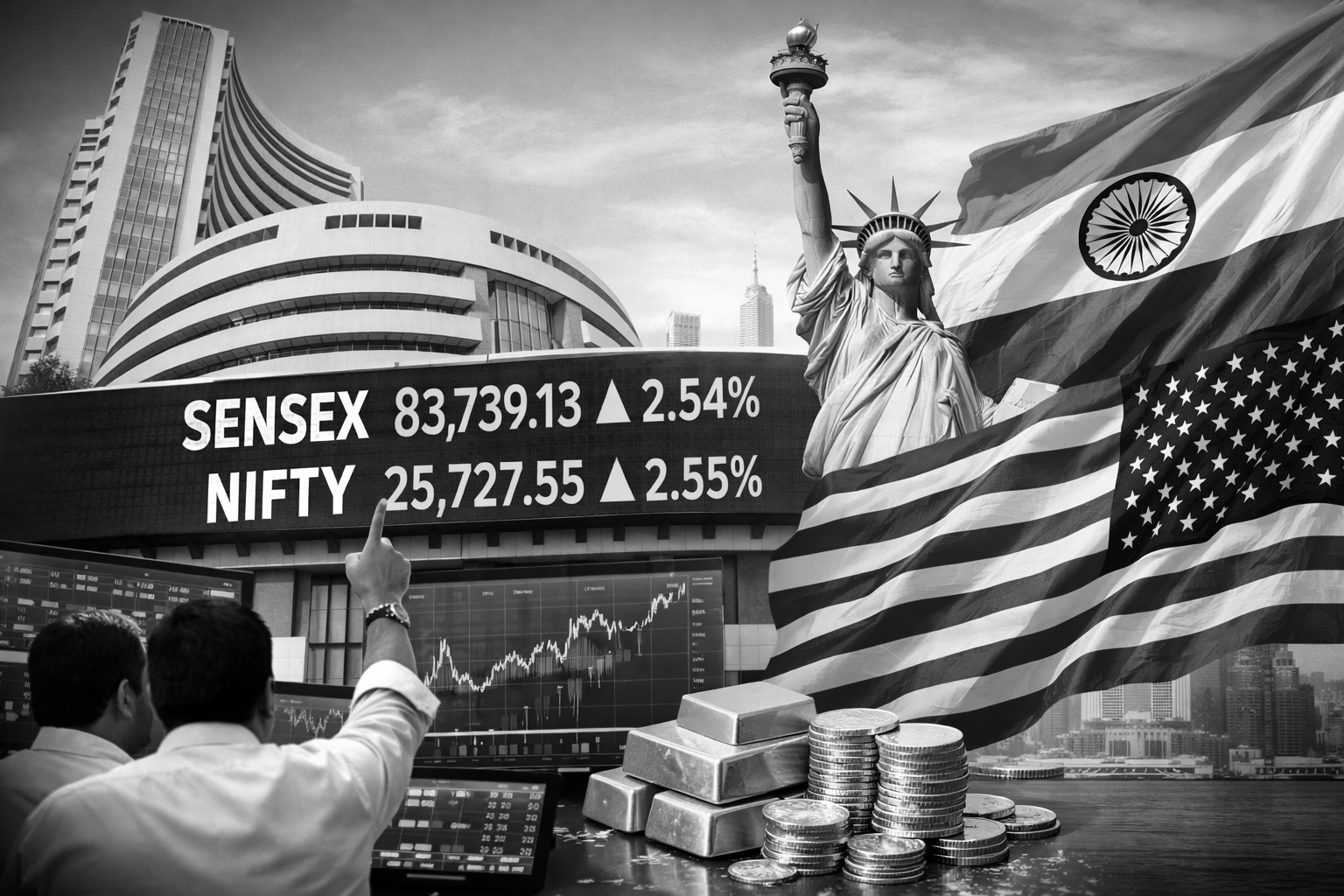

Sensex, Nifty Jump 2.5% as India–US Trade Pact Offsets Budget Shock

Indian equity markets staged a powerful rebound on Tuesday, with the BSE Sensex surging 2.54% to close at 83,739.13 and the NSE Nifty 50 rising 2.55% to settle at 25,727.55 , as investors welcomed a landmark trade agreement between India and the United States . The US decision to reduce reciprocal tariffs on Indian goods to 18% from 25% lifted sentiment across sectors, helping markets recover from recent Budget-driven volatility and restoring confidence in export-led growth.

The rally marks a decisive shift after markets had faced turbulence following the Union Budget, where tax measures and valuation concerns triggered profit-booking and sharp swings. The trade pact acted as a sentiment stabiliser, with analysts noting that a predictable tariff regime improves earnings visibility for exporters and strengthens India’s global trade positioning.

Gains were broad-based, with logistics, financials, infrastructure and export-oriented stocks leading the advance. Shares of Adani Ports climbed on expectations of stronger cargo volumes, while financial heavyweights Bajaj Finance and Bajaj Finserv rallied as risk appetite improved. Infrastructure major Power Grid Corporation of India and aviation player InterGlobe Aviation also posted solid gains. Export-linked segments such as textiles, chemicals, auto components, gems & jewellery, leather and seafood exporters attracted strong buying interest due to improved price competitiveness in the US market.

In commodity markets, precious metals remained firm. 24-karat gold was priced at approximately ₹1,53,930 per 10 grams , while 22-karat gold stood near ₹1,41,100 per 10 grams , reflecting continued safe-haven demand. Silver traded around ₹2,80,000 per kilogram , or roughly ₹2,800 per 10 grams , indicating stable industrial and investment demand alongside the equity rally.

Market breadth stayed positive, with only a few defensive and select technology counters lagging as investors rotated toward cyclical and trade-sensitive sectors. Analysts said improving India–US economic relations represent a structural positive for India’s capital markets, encouraging foreign portfolio flows, supply-chain diversification and stronger long-term growth visibility. Combined with easing crude oil prices and supportive global cues, the trade deal has helped reset market sentiment, signalling the possibility of sustained momentum in export-driven and financial stocks.