From QR Codes to Cross-Border Payments: India’s Digital Model Wins Worldwide

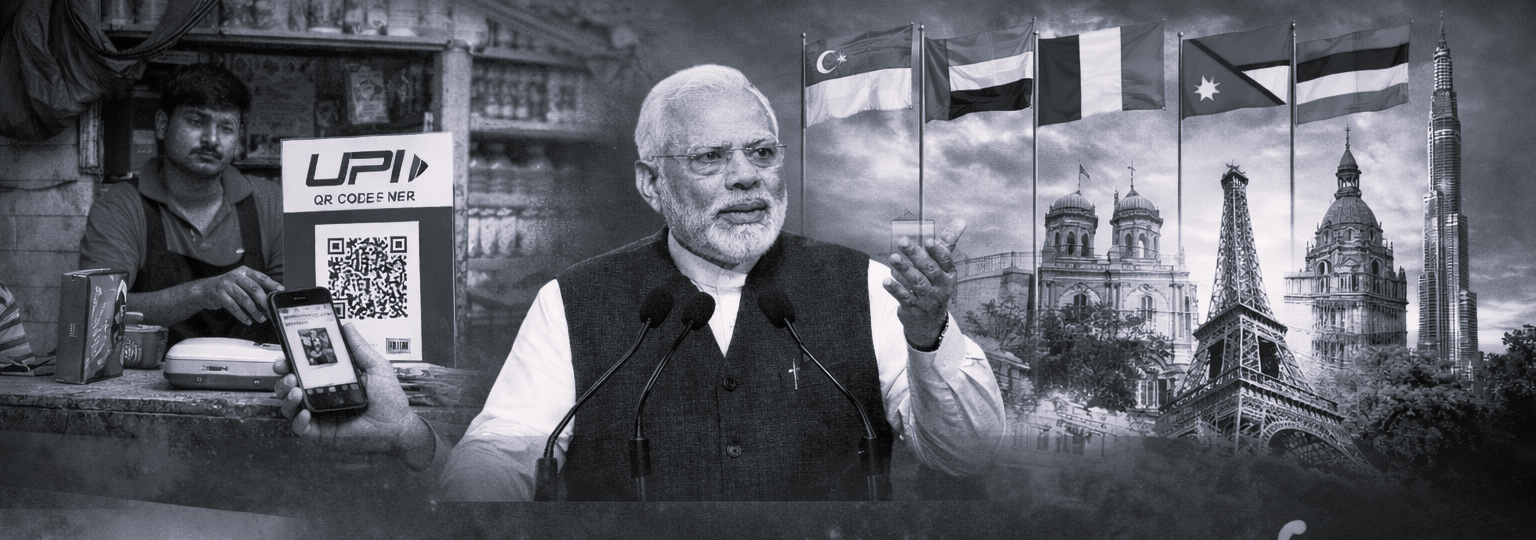

India’s Digital Public Infrastructure (DPI), once designed to solve domestic challenges of scale and inclusion, is now emerging as a global template for digital transformation. At the recent AI Impact Summit, Prime Minister Narendra Modi highlighted how India is sharing its digital architecture with partner nations, positioning technology as a public good rather than a tool of dominance. The model built on open standards, interoperability and affordability is increasingly being adopted or studied by countries across Asia, Africa and Europe.

At the heart of this transformation is the Unified Payments Interface (UPI) , developed by the National Payments Corporation of India (NPCI) . Originally launched to enable real-time, low-cost digital payments within India, UPI has now expanded beyond national borders. It is operational or integrated in countries such as Singapore, the United Arab Emirates, France, Sri Lanka, Mauritius, Nepal and Bhutan, allowing Indian travellers and businesses to transact seamlessly abroad while also strengthening remittance corridors. NPCI has additionally introduced the “UPI One World” wallet to enable foreign visitors to make digital payments in India without needing a domestic bank account.

India has also signed Memorandums of Understanding with over 20 countries to share expertise on digital identity, payment systems and data governance, reflecting growing global interest in what is commonly known as India Stack the integrated framework comprising Aadhaar, UPI, DigiLocker and Account Aggregator systems. Nations including Armenia, Sierra Leone and Suriname are engaging with India to adapt elements of this open digital architecture to their own governance needs. For many developing economies, the appeal lies in the low-cost, scalable and vendor-neutral design of India’s infrastructure.

Global corporations have also built on India’s digital rails. Companies such as Google , Walmart , and Amazon operate on UPI infrastructure, while international payment networks like Visa and Mastercard have introduced UPI-linked credit products. This hybrid ecosystem public digital infrastructure enabling private innovation has become a distinctive feature of India’s technology model.

The sharing of DPI is also extending into artificial intelligence. Through initiatives such as AIKosh , India is making datasets and AI models available as shared national resources, while investing heavily in computing infrastructure under its AI Mission. The broader strategy mirrors the DPI approach: build foundational public infrastructure first, then allow startups, enterprises and global partners to innovate on top of it.

India’s DPI journey represents a shift in global technology diplomacy. Instead of exporting proprietary platforms, the country is offering digital public goods scalable frameworks that other nations can adapt to accelerate financial inclusion, governance efficiency and economic growth.