ED launches probe into Nedumparambil Credit Syndicate investment scam in Kerala

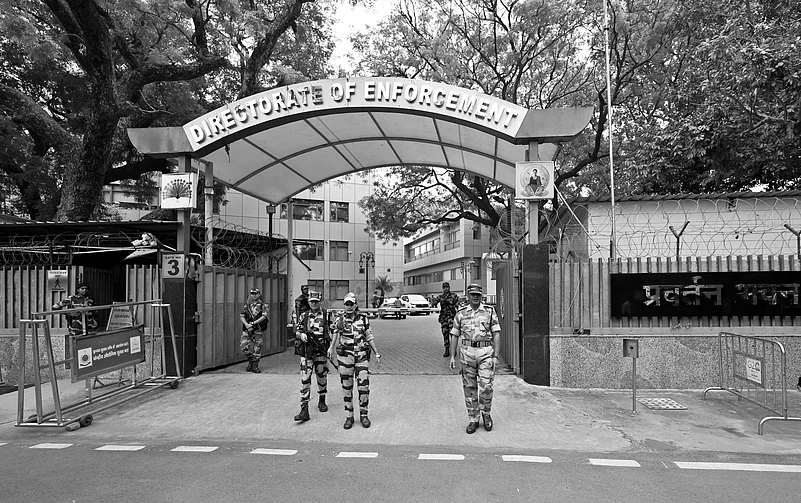

The Enforcement Directorate (ED) on Thursday conducted extensive searches in Kerala targeting promoters and key functionaries of the Nedumparambil Credit Syndicate Group (NCS Group) as part of a federal money‑laundering investigation linked to a massive alleged investment fraud. The ED has registered a case under the Prevention of Money Laundering Act (PMLA) after taking cognisance of multiple FIRs filed by the Kerala Police, which accused the syndicate’s leadership of defrauding depositors by promising high returns that were never paid.

Preliminary findings by the ED indicate that several depositors across Kerala invested substantial sums which were neither returned nor yielded the promised interest. Bank account analysis of entities linked to the group revealed extensive financial transactions, diversion of funds to multiple related entities, and significant cash withdrawals. Officials also allege that some of the diverted funds may have been invested in immovable properties across the state to conceal the proceeds of crime.

The syndicate, which operated a network of over 150 branches across Kerala, attracted investors with promises of high interest rates on deposits. Victims, including senior citizens and people living abroad, reported that their principal and interest were denied upon maturity, prompting multiple complaints. Police records show that the total number of cases connected to the syndicate’s fraud exceeds 26 FIRs across various districts, with losses ranging from lakhs to crores of rupees.

Kerala Police registered cases under sections of the Indian Penal Code including cheating and criminal breach of trust, along with the Banning of Unregulated Deposit Schemes (BUDS) Act. Several key figures, including N. M. Raju , the firm’s owner and a former treasurer of Kerala Congress (M), his wife Grace Raju, and their sons Alen George and Anson George, were arrested earlier by police, with additional staff and relatives later named as accused.

The ED’s action involved coordinated raids under Section 17 of the PMLA to secure documents, digital records, bank statements, and other evidence to trace the movement of funds. While the agency has not confirmed new arrests tied to these raids, officials said the focus remains on financial forensics and asset tracing to establish money‑laundering links.

Authorities continue to examine whether the diverted funds were used to acquire properties or other assets, and whether additional individuals or entities were involved in layering transactions to conceal the origin of the money. The case remains under active investigation as the ED works to build a comprehensive money‑laundering and investment fraud case.