Draft rules released for new Income Tax Act: public invited to give feedback

The Income Tax Department on Saturday released draft rules and simplified forms under the Income Tax Act, 2025 , which will replace the six-decade-old Income Tax Act, 1961, from April 1 . The department has invited comments from taxpayers and other stakeholders on the draft Income-tax Rules, 2026 , and forms till February 22 .

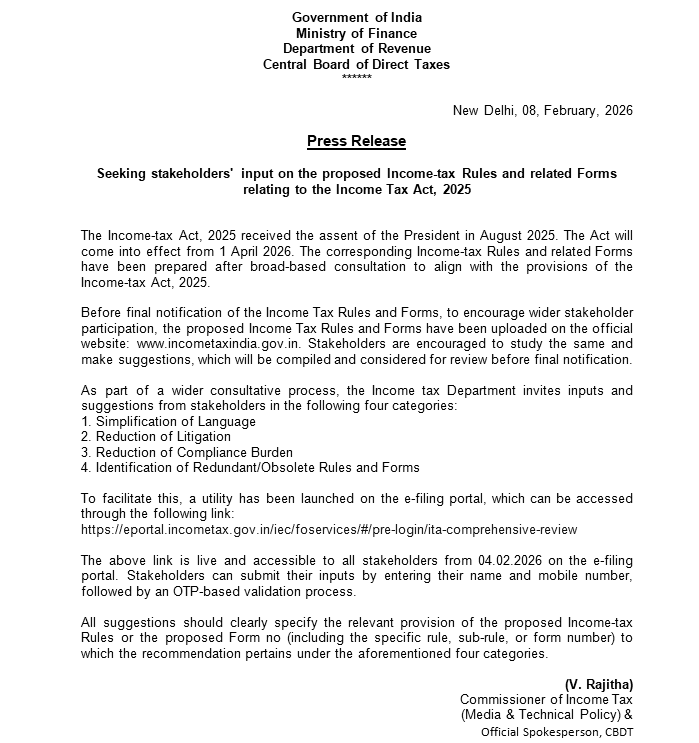

Taxpayers can submit their feedback through the Income Tax Department’s dedicated portal at

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/ita-comprehensive-review .

The new Income Tax Act, 2025, aims to simplify provisions, reduce compliance burden and make the tax framework more taxpayer-friendly. While it does not propose any change in tax rates or introduce new taxes, it rewrites existing provisions in simpler language, removes redundancies, consolidates similar sections and reduces excessive cross-referencing to improve clarity and ease of understanding.

The new Act will replace the Income Tax Act, 1961 , which governs levy, collection and administration of income tax, including provisions related to exemptions, deductions, assessments, penalties, prosecution and appeals. Over the years, frequent amendments have made the existing law complex and litigation-prone.

As part of the transition, the department has released draft Income-tax Rules, 2026, and revised income tax return forms. According to the department, the current Income-tax Rules, 1962 contain 511 rules and 399 forms , while the draft rules have been reduced to 333 rules and 190 forms through rationalisation, removal of redundancies and consolidation.

The department said the new forms have been significantly simplified, with standardisation of common information to reduce compliance requirements. The forms will support pre-filled data and automated reconciliation , making filing more intuitive and less error-prone. The language has also been simplified to avoid operational, administrative and legal ambiguity.

Public response to the proposed law has been cautiously positive, with many taxpayers welcoming the promise of simpler provisions, fewer forms and pre-filled returns. Salaried taxpayers say the changes could reduce dependence on tax consultants, while small businesses see potential relief from frequent rule changes. However, some taxpayers have said the real impact will be clear only after implementation and have raised concerns about increased digital compliance, particularly for senior citizens.

To assist stakeholders, the department has also released two navigators — one mapping the old rules with the new draft rules and another mapping the existing forms with the proposed forms.

Tax experts have also welcomed the draft. Nangia Global Partner Sandeepp Jhunjhunwala said the rationalisation of long-standing perquisite thresholds, such as tax-free at-work meals and gifts from employers, aligns the tax framework with current economic realities. Grant Thornton Bharat LLP Partner (Tax) Richa Sawhney said technology-driven features like pre-filled and reconciled forms would reduce compliance time and minimise errors.